Finally - banking innovation as well as big data are high on the agenda for financial solutions C-suites. Banking leaders identify that the ability to essence as well as utilize data held within their service procedures - and also to automate document procedures in their worth chain, offer significant competitive advantage. At the same time, as open financial becomes a better banking fact of life for both consumers as well as financial institutions, it introduces brand-new methods for producing income streams.

Nonetheless, in several organisations, there are barriers blocking those possibilities. Often it's budgetary restrictions; other times, it's just a lack of support and/or understanding throughout business.

Here are 5 pushing factors to re-prioritise smart record processing (IDP) in your digital change program, and also tear down those obstacles individually.

1. Big information in banking is a major, unmissable opportunity

As opposition banks continue to interrupt the monetary services landscape, conventional financial institutions have one fantastic benefit-- the huge quantities of data they hold connecting to their customer bases and also sections. Car loan applications alone generate mountains of data to please back-end processes. Yet this information isn't constantly in a kind that can be accessed; neither is it verified for its stability.

Being able to automatically analyze customer files for intelligent understandings opens useful data for banks, which can after that be fed right into other locations of the business, or right into applications. From there, banks can develop products to satisfy the needs of retail, SME and business customers and also liquify their pain points; they can enhance the client experience, and also make it possible for economic health and wellbeing conversations between consumers and the sector.

Information powers personalisation, opening up interaction with consumers concerning products at the right time, in a way that makes good sense to individuals. Client information becomes a source to form strategy.

IDP makes use of a collection of technologies - from expert system (AI) as well as artificial intelligence (ML) to optical character recognition ( OPTICAL CHARACTER RECOGNITION) and also natural language processing (NLP). These enable banks to capture, identify, as well as remove data kept in papers, turning unstructured and semi-structured data into a structured format.

Intelligent automation innovation can then be related to the extracted information for improved recognition and to immediately enter it into existing applications. Advanced analytics enable reporting and also understandings in real time from multiple sources, so organisations can take in, evaluate and also perform on the understandings, feeding right into the bank's value suggestion.

2. The COVID result: new assumptions from end consumers

With social distancing limitations, lockdowns as well as a mass work-from-home motion in lots of markets, we have actually seen a revolution in consumer interaction.

It began with a mass trip to digital channels across both retail as well as commercial banking, accompanied by increasing download prices for applications, especially in the very early months of the pandemic.

" The financial institutions are currently reprioritising their electronic improvement programs," says Sandstone Modern technology CEO Michael Phillipou.

" 18 months earlier, a bank may have had a roadmap of 3 years of programs they were mosting likely to be attending to. Now they know they require to increase that financial investment, reprioritise several of those programs, and generate brand-new priorities to ensure they've got market-leading digital value propositions."

" This speed as well as agility is something we have actually never seen prior to," Phillipou says.

Overnight, digital remedies have actually been developed to fulfill consumers' demand for security and also benefit, and also cashless payments as well as international settlements have actually became necessary.

" We additionally suddenly saw a need for instant gratification," states Phillipou. " Getting the answer promptly and also having the ability to communicate with your financial institution, either by self service or by a lender on the other side, are now anticipated as a matter of course."

Keep in mind that in an setting of increasing cybersecurity violations, new banking modern technology requires to be balanced with conformity, info protection and also threat management. "If settlement systems were to go down, that would certainly have a devastating result economically and also ruin trust in organizations," Phillipou claims.

3. Digital borrowing remedies will certainly constantly have heavy conformity commitments

Financial institutions have a conventional account as well as appropriately so. They have considerable and also ever-changing regulatory obligations to abide by, as well as layers of stakeholder approvals to safeguard before onboarding any brand-new capabilities.

" As such, established financial institutions normally aren't innovation leaders," Philippou claims.

Nevertheless there is a massive opportunity for banks to improve their capacity to fulfill governing conformity promptly and easily-- through automated IDP products like Sandstone's DiVA.

Queen gives clients verified as well as auditable regulatory conformity through an integrated policies engine without code configuration needed.

As well as because queen is Software as a Service, it's quick to execute. A financial institution might conceivably establish IDP across their business in a issue of weeks.

" This is what financial technology will certainly look like across the board in the future," Phillipou claims. "Cloud indigenous, cloud based, API initially, containerised, with microservices-- every one of these with each other allow rapid release and also quick realisation of advantages. Being usage based, the item can be turned on and also off rapidly."

4. The drive for efficiency gains across the board

According to Phillipou, from the bank's perspective, every board is being asked to do 3 points. The initial is to raise their return on resources, and that implies expanding their assets, their lending books and liability books.

The 2nd: they need to currently do even more with much less, by decreasing their cost-to-income ratio. As well as finally, number 3 is to follow all laws and also avoid fines.

" With regards to the 2nd factor, this is absolutely an performance play," Phillipou says. "The best digital loaning solution will lead to decreased time to refine finances, which's the primary usage case our clients are using our ability for. Smart file processing is a vital element of that."

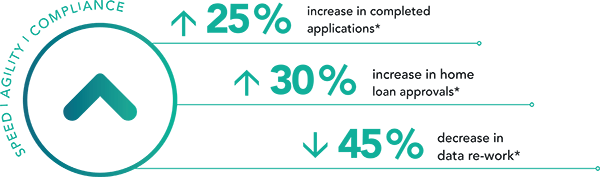

With smart automation, banks can start to release lendings bent on customers at a much better speed than they might have or else. Personal information can be redacted, files can be rotated and also translated as well as indexed. And also with even more precision in the method they refine info, and little or no re-keying of details, the error price with clients is far lower.

As the process becomes a lot more reliable for organisations, they can redeploy those back-office sources into other areas where they can get a better influence. It has to do with cost financial savings for clients and also a far better consumer experience with fewer pain factors.

Ultimately financial institutions are functioning in the direction of the idea of right with handling (STP): absolutely digital handling of financial deals from the point of initial ' offer' to last settlement, including no manual intervention. The goal is to achieve far better rate, precision, dependability and also scalability.

5. The open financial future counts on excellent, large data in financial

The staged introduction of open banking and the opening of APIs to 3rd parties has actually been an additional incentive for modification, aiding shift industry focus onto the value of information stability and accessibility.

Financial institutions require to be able to seize the opportunities this offers. That includes opening ' industries' to aid construct out their own product set and also check out new earnings streams for the business. These might consist of anything from re-selling to economic understandings for retail as well as organization banking.

As Philippou claims, "From our side, as a innovation companion, we're seeing far more requests for remedies to satisfy these needs today."

There is no question that banks need to be data driven if they intend to supply better financial services and products to satisfy customers' demands as well as assumptions; and also if they intend to make use of opportunities as they arise.

At the same time, they need to drive performance as well as performances throughout the business, while minimizing operational danger. The moment has actually pertained to adjust, as well as do it promptly.