It's an intriguing time in monetary innovation.

First, we're operating in a distinct financial atmosphere. Cash is affordable, which has actually prompted a series of mergings as well as purchases in banking, with smaller sized gamers merging to attain larger scale. This boosting rationalisation in the marketplace means banks require systems that can assist in the range of growth that they're looking for to achieve.

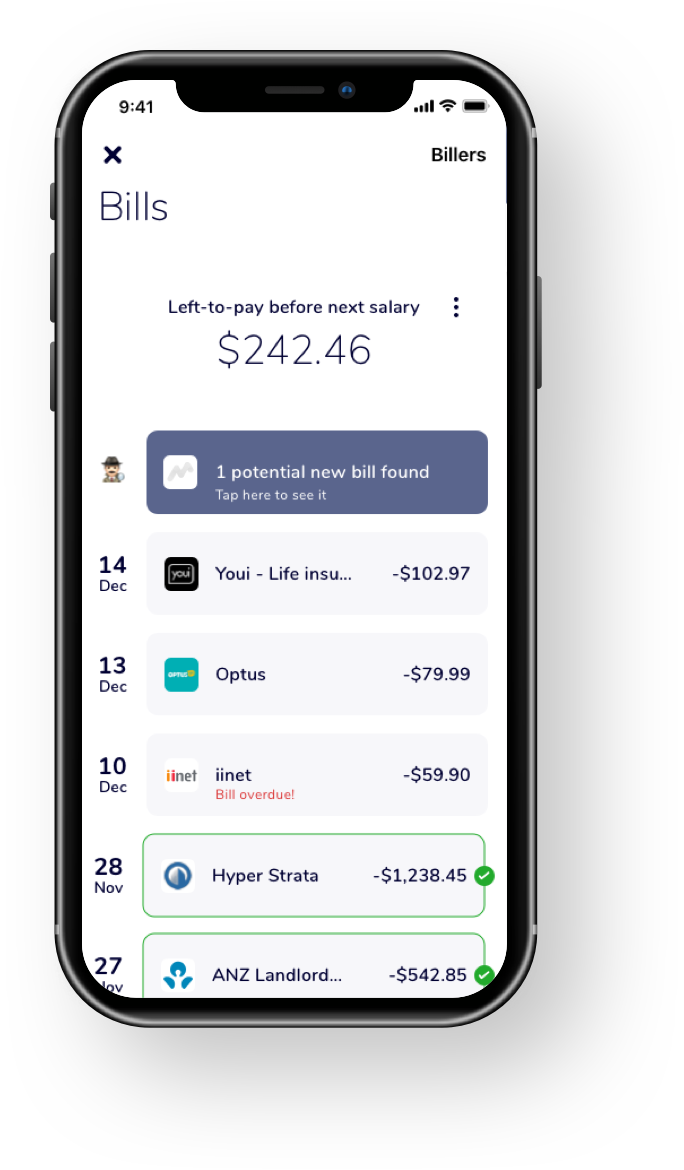

Clients are calling the shots. And also they uncommitted what's happening in the back end. As Phillipou says, "It's banking advancement in front-end applications that they observe-- making it much easier negotiate on the internet consisting of to transfer cash, take out cash, obtain money, obtain a credit card, pay."

The essential component is the involvement and interaction they are experiencing; how easy is it to open up an account and end up being a client electronically. A bank's system needs to be able to automate procedures and also give a smooth experience for the client.

If a financial institution is looking to replace or adjust aspects of its core banking system to deal with customer assumptions and growth goals, it's going to be a risk/benefit trade-off.

Right here is where the sixty-four-thousand-dollar questions can be found in, according to Phillipou. "Do they see the value in investing thousands of numerous pounds doing a improvement of that gravity? Or, if their core system can still do the fundamentals and advance by means of upgrades, should they be investing in front-end applications that enable them to supercharge their development as well as please customer expectations?" he claims.

Analyzing systems

A core financial platform is the engine that drives the financial institution's main procedures, responsible for the opening and also upkeep of financing and checking account, preserving the main record of transactions, passion and also even more. It's the ' resource of truth' for account condition and also account data which are accessed by other systems as well as feed consumer networks.

Platform, institutions have account opening/origination systems which gather consumer information and also handle the application process by communicating with the core financial engine. As well as there are account servicing systems that allow clients as well as internal individuals to inquire their account status and transact on their account.

Both added systems may be provided by the core banking supplier and also classed as component of the core banking engine, or they might be a different system/product that is integrated with the core financial engine.

Exists a 3rd alternative?: Fintech service providers like Sandstone Technology offer services that can be incorporated with the core financial engine after the reality. These fintech integrations are generally accomplished through standard APIs which aid streamline the integration and allow a brand-new company to much more conveniently weave the solutions perfectly right into those of various other modern technology suppliers.

City of London at sunset and organization network connections principle image with lots of business icons. Technology, improvement as well as technology idea.

Threat, and why adjustment has been so slow

The majority of core banking systems have been in situ for years, sometimes decades. Big quantities of money and also resources have actually been invested. Benefits aren't immediate, they're counted over years. " As soon as a financial institution has done its benchmarking as well as made a decision to invest in a core financial system, they're devoted for the longterm," Phillipou claims. "They will not be crossing out that level of investment quickly."

Add in the truth that financial https://www.sandstone.com.au institutions, typically, are infamously extremely risk-averse organisations. They require to be traditional, due to the fact that they're custodians for people's cash. They require to make certain they have systems, processes, as well as a threat appetite method that remains in line with their consumers' assumptions, to guarantee customer self-confidence and also information security.

As Phillipou describes, the greatest threat they are subjected to when migrating off an older information system is execution threat. " First of all, these kinds of programs are complex as well as popular for running over timetable which has substantial effects for banks," he claims. "What may occur as a compelling suggestion in the tendering process can, once executed, become an functional as well as expensive nightmare for the financial institution."

Numerous CTO as well as CIOs get distressed when they look at core financial changes that have actually gone southern, like Royal Bank of Scotland, whose ill-fated software upgrade in 2012 led to an failure leaving millions of clients unable to make or get payments. RBS was fined 56 million pounds by British regulatory authorities in 2014.

When CTOs, CIOs and various other decision makers choose to transform their core systems, they require to win the hearts as well as minds of the board and the executive right across the organisation. It's frequently not an very easy sell.

Front-end combinations are the trick to growth

Several institutions are in the challenging placement of being beholden to ageing, monolithic core financial systems where adjustments as well as updates to their systems are commonly intricate, time consuming and pricey. Purchase handling is crowded, financing handling is sluggish and also they might not have the capacity to user interface right into their front-end applications to the level they 'd such as. The system can't do what they need it to do, to fulfill growth objectives as well as goals.

In the end, growth significantly comes using the financial applications that are client encountering, Progressively banks are identifying that brand-new front-end applications will obtain a higher return on investment than a significant core change.

Frontend services can involve sprucing up the entire customer-facing style, or just making little tactical modifications to procedures that influence the consumer experience.

With smooth UX throughout digital banking capacity through applications, "it resembles opening up a window to a store" Phillipou claims, aiding financial institutions open accounts quickly, onboard consumers rapidly-- all of those retail banking needs. It's developing that electronic value recommendation which provides banks the ability to complete as well as win, ensuring they're preserving existing clients, growing their client base and also market share, as well as boosting track record.

Quick, dexterous assimilations with Sandstone Technology

A banking combination specialist, Sandstone Modern technology can deal with any type of core banking system company. Release is fast - in between 3 and year depending on the complexity of the release as well as the bank's interior procedures.

Sandstone Technology is a relied on electronic partner to tier 1-3 financial institutions, building cultures, participant community possessed financial institutions and credit unions with clients across Australia, New Zealand, Asia as well as the United Kingdom.